Associated British Foods with one of my favourite retail chains Primark arrived with their release concerning the full year 2015. Later on a nice report will be made but I care about the figures and not the pictures so I am happy enough with this. The market reaction was not filled with warmth and there was a couple of %-age points drop but much less than what I would have thought to be honest when I read the report.

For the report in full please go here and for the previous report from ABF please visit ABF annual report 2014 and to find out more regarding ABF please click on analysis of ABF 2014.

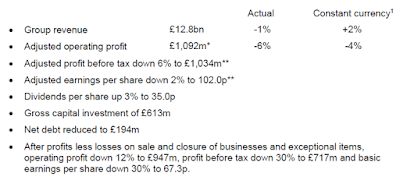

Let us start with what they called the headlines. Already here I start to raise my eyebrow slightly because of the attempt to smooth out the result by pushing on currency effects. Well... To me that did not work at all. Seeing an OP of -6% or -4% I simply could not care less because both are bad.

Then we should take a look at the financial statement and here we see that just like it was stated the revenue is down, we also see that there is a -100 million exceptional item which comes from an impairment cost due to the Vivergo Fuels (converting wheat to bio-fuel) that was bought out from BP. They also claim that Vivergo will continue to generate losses until the macro environment changes in favour of Bio-fuels again. Hmmm... these kind of things makes me a bit confused. I mean when BP that have been working for many years with oil and gas and everything around that decide to sell something that is within their circle of competence then I would be concerned. To have a unit that converts wheat and not rubbish by-products to bio-fuel I also find very questionable.

The operating profit is down and the profit for the period is down by -33%. Woow! That is indeed a lot and it is hard to swallow!

When looking at the segments then Grocery, Agriculture and Ingredients had all lower revenue and higher operating profits. Sugar had significantly lower revenue AND profit and of course my darling Primark had increased revenue, only 8% though, and increased operating profit but also here very low with only 2%. The currency effect have hit them hard but that is not all. The sugar segment have gone from bad to worse and they expect it to start looking a little bit better in the coming years... well... it better because otherwise they need to get rid of it.

I also wanted to show this store summary for Primark as a bit of an indicator how much room they have to grow. They decided to mention that the stores had been very well accepted in France but my concerns is that nothing and I do mean nothing was mentioned regarding the flagship store in Boston because that to me is bad news. I checked some articles and tried to find out things online but all I could see where newspaper mentioning that Primark had taken over a old famous retail building down town and that they would become a hard competitor to the American (Forever 21) and other European stores (H&M) that were already present in that area. I did however find nothing about visitors when trying to read up but there were a couple of Primark Haul videos from Boston so I watched them. Complaints about that the sizes were different and that there were too many people in the stores. The footage that I saw from inside the store was however nothing in comparison to what I see here in Berlin. Let us give it some time for the American youths to get used to Primark.

Conclusion: It was a horrible report. With Grocery, Agriculture and Ingredients they have managed to tighten their costs so those segments are doing good even with decreasing revenue but there is no stopping in the revenue and profit decreases for sugar. Imagine if ABF would not have had Primark to cushion the fall! Primark is revenue- and profit-wise doing so, so but the amount of customers in the stores are still great which then also means that I will remain as a shareholder in ABF.

No comments:

Post a Comment