Yet another bad quarter was published by IBM when they announced the third quarter earnings. The shareholders were unhappy and the share price dropped with as much as -5% on the news but no one walks out the door without another one entering.

For the report in full please go here, for the previous summary please see IBM report Q2 2015 and to find out more regarding IBM then please click on analysis of IBM 2015.

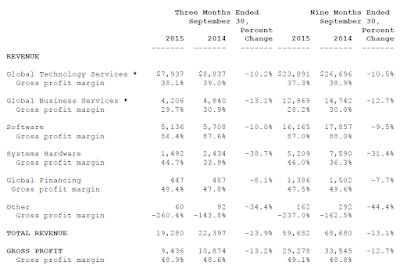

As can be seen below in the financial statement it certainly is not uplifting entertainment. The %-age changes that I hoped would have become better in Q3 have either remained as they were or even become worse in some cases. They have divested System x business which in combination with currency effects have lead to very strong revenue fluctuation compared to 2014. Their tax rate is now down at around 18% which I find disturbingly low on top of things.

Conclusion: The journey for changing IBM is far from finished and the lift up they got from a weak dollar is now smacking them in the face. Their forecast for the full year I find to be very far fetched since they still claim EPS of USD 14 to 15 and they are currently at around 8.9 USD for the running three quarters. I will remain as a shareholder in IBM and I will think a little bit about if I should increase my holding or not.

My blog neighbour Michael C. Kissig published the article IBM kriegt einfach die Kurve nicht (mehr)... and if you do not understand German then please use online translators. He is, and also justifiably so, negative towards IBM. It is wonderful how investors can look upon the very same companies and come up with completely different conclusions. Many times an emotional attachment (aka already owning shares) will cloud the conclusion.

My blog neighbour Michael C. Kissig published the article IBM kriegt einfach die Kurve nicht (mehr)... and if you do not understand German then please use online translators. He is, and also justifiably so, negative towards IBM. It is wonderful how investors can look upon the very same companies and come up with completely different conclusions. Many times an emotional attachment (aka already owning shares) will cloud the conclusion.

No comments:

Post a Comment