The Q1 report from BASF is also since some time out and what I liked in this report is that already on page 4 they describe a new invention made by them. I hope it will continue like that so that we shareholders in each report get a brief and clear description of what our money is being spent on and also in which direction the company is going towards in the future. So what was in it?

For the report in full please go here and for the latest summary which was the BASF annual report 2014 then please click on that link and to find out more about The Chemical Company then please visit analysis of BASF 2015.

Let us take a look at their highlights and there we find that they managed to slightly increase their revenue which is good but costs also ended up higher and in the end they were -20% on the earnings compared to 2014 (a quarter with still high oil prices and weak dollar). I am not happy about it but I still find it ok. The big eye catcher were the personnel costs that were happy, happy, joy, joy up with 23%! 23%! I also want a 23% salary increase! The reason for it was, according to them, due to currency effect, the long term bonus program as well as due to that BASF celebrated 150 years and then the current employees received a bonus. A party I can understand and pay for which should of course then also include the shareholders... a salary bonus to the current employees I simply do not understand and I only find it a silly reason to extract money from the shareholders.

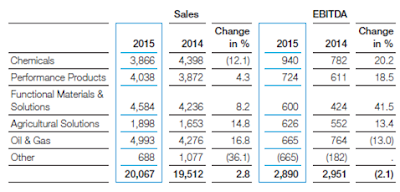

Since I was hoping that BASF would, due to their oil and gas, work a bit like the oil companies with their Upstream and Downstream I wanted to look closer also at the segments and I must say that I was a bit confused since Chemicals are significantly down in sales with -12%, two flat and Agriculture did very well with+15% and Oil & Gas is up by 17%. So they tried to cover the decreased Oil price by higher output which I understand and happily all the other segments could enjoy higher margins but below the line we still got less out. Why then less out? Due to the Other segment. BASF have their own, like the banks, None-Core Business that is there but you know... we do not really use it so let us not count and look at it unless we really must. In others we find their failed hedging, the bonus program and sales of raw materials.

Since I was hoping that BASF would, due to their oil and gas, work a bit like the oil companies with their Upstream and Downstream I wanted to look closer also at the segments and I must say that I was a bit confused since Chemicals are significantly down in sales with -12%, two flat and Agriculture did very well with

Conclusion: Due to that BASF is hedged like an oil company they are doing very well no matter if oil price is high or low. There were things I did not like in the report but overall things are going fine for BASF and I will remain as a shareholder. It also pleases me that Agriculture is going well and I see that not only with BASF but also with Tessenderlo and I hope one day to see that also with Kernel.

No comments:

Post a Comment